Let’s talk about Gold…

Many analysts believe that the precious metal is DEAD due to its having fallen from a record high of $1900 per ounce to roughly $1200 per ounce today (a 36% drop).

However, this price movement, while dramatic, is quite inline with how commodities trade. Gold has already posted one drop of 28% (in 2008) during its bull market, before more than doubling in price. This latest drop is not much larger.

Moreover, a 36% drop in prices is nothing in comparison to what happened during that last great bull market in Gold back in the 1970s. At that time, Gold staged a collapse of nearly 50%. But after this collapse, it began its next leg up, exploding 750% higher from August ’76 to January 1980.

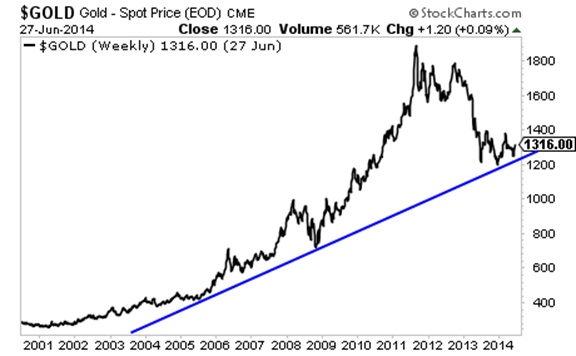

Again, a 36% drop in gold prices is perfectly in line with Gold during a bull market. Indeed, despite this drop, Gold maintained its long-term trendline:

With that in mind, we believe the next leg up in Gold could very well be the BIG one. Indeed, based on the US Federal Reserve’s money printing alone Gold should be at $1900 per ounce today.

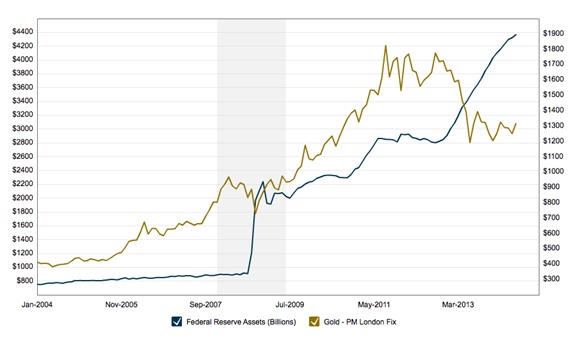

Since the Crash hit in 2008, the price of Gold has been very closely correlated to the Fed’s balance sheet expansion. Put another way, the more money the Fed printed, the higher the price of Gold went.

This relationship was skewed in 2011 when Gold got bubbly (hence the sharp correction we were talking about earlier). But at this point, it’s dramatically undervalued relative to the Fed’s balance sheet.

Indeed, for Gold to even realign based on the Fed’s actions, it would need to be north of $1,900. That’s a full 30% higher than where it trades today (see below).

Indeed, from a technical analysis perspective, Gold is close to breaking out of a wedge pattern:

If we stage a breakout to the upside, then we’re off to the races and that $1,900 price per ounce target is in play.

This concludes this article. If you’re looking for the means of protecting your portfolio from inflation, you can pick up a FREE investment report titled Protect Your Portfolio at http://phoenixcapitalmarketing.com/special-reports.html.

This report outlines a number of strategies you can implement to prepare yourself and your loved ones from inflation’s jaws of death.

Best Regards

Phoenix Capital Research