The U.S. Empire is in real trouble. This is due to its idiotic business model of selling quality assets while acquiring massive liabilities and debts. Of course, the U.S. Government realizes this is not a sustainable way to do business, but at least for now…. we continue to have our Bread & Circuses, McDonalds & NFL Football for a bit longer.

Furthermore, Americans have no clue that the U.S. Dollar’s world reserve currency status continues to disintegrate each passing day as more countries elect to by-pass the Dollar and trade in other currencies… especially the Chinese Yuan.

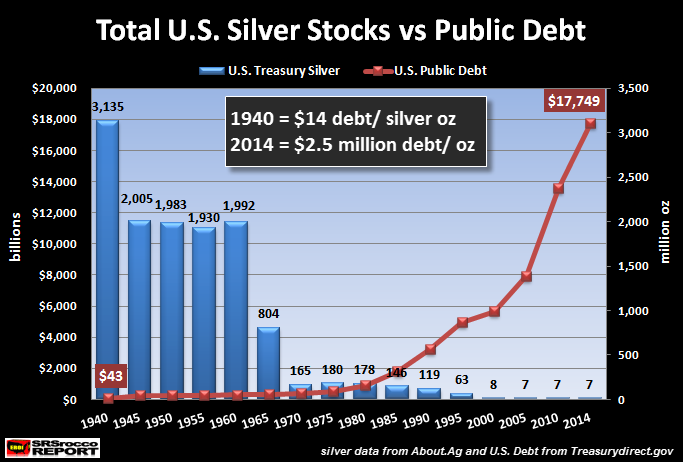

The Total Liquidation of U.S. Silver Stocks

One such asset the U.S. Government totally liquidated is its massive stocks of silver. In 1940, the U.S. Treasury held 3,135,000,000 oz of silver. That’s correct, 3.1 billion ounces. That is nearly four times the current annual world mine supply of 820 million oz.

This figure is documented on page 64 in the USGS 1940 Gold-Silver Minerals Yearbook:

The U.S. Empire is in real trouble. This is due to its idiotic business model of selling quality assets while acquiring massive liabilities and debts. Of course, the U.S. Government realizes this is not a sustainable way to do business, but at least for now…. we continue to have our Bread & Circuses, McDonalds & NFL Football for a bit longer.

Furthermore, Americans have no clue that the U.S. Dollar’s world reserve currency status continues to disintegrate each passing day as more countries elect to by-pass the Dollar and trade in other currencies… especially the Chinese Yuan.

You will also notice that the U.S. held nearly $22 billion of the total $30.5 billion in world gold reserves. This was an amazing 72% (approximately 20,000 metric tons) of total world gold reserves.

Currently, the United States supposedly has 8,000 metric tons of gold in reserve. Unfortunately, we have no way of knowing how much gold is really there and if so, how many claims are on each ounce. Some analysts such as Harvey Organ, believe the U.S. gold vaults are totally empty.

While it’s nearly impossible to know how much public gold remains in the vaults of the U.S. Government, we have a pretty good idea of its silver inventories.

This next chart shows the massive decline in U.S. silver stocks from 1940 to present. As you can see, silver stocks at the U.S. Treasury declined from 3.1 billion ounces in 1940 to 7 million ounces currently. This is a staggering 99.99% decline.

Continue reading at SRSrocco Report